Walnut Term Life Insurance Review

Life insurance policies are quite useful and necessary policies since they allow beneficiaries to have economic support not only in the event of the insured’s death but also in case he/she becomes disabled. However, these policies are not always easy to implement, so we present Walnut Term Life Insurance, a product with two attractive features: accessibility and simplicity.

Far removed from negative stigmas and taboos, being prepared to face unwanted events is more of a necessity than a luxury. Faced with the death of a loved one or an illness or accident that leaves you incapacitated, it is normal to feel great pain and emptiness, but this does not eliminate the financial responsibilities that are generated. That is why being prepared to protect the people we love is wise, even if we are not around.

Once we have decided to take out life insurance, the task of comparing and evaluating the immense choice of insurance companies follows. Each person has different circumstances that will make him/her decide on one option, and this time we will focus on giving you the details of one of these alternatives: Walnut Term Life Insurance. Let’s see what the characteristics of this product are, how to contract it, its costs, and its advantages and disadvantages.

What is Walnut Term Life Insurance?

Walnut is an insurance company based in Toronto, Canada, with offices and registration in the United States. Their main goal is to simplify insurance and make it more accessible, so they have taken insurance basics and applied a digital transformation process. The result: simple, accessible, easy-to-contract insurance with transparent costs.

Their main product is Term Life Insurance, a policy that is 100% online and has multiple benefits. But before detailing the characteristics of this product, it is important to know what term life insurance is.

A life insurance policy is a coverage policy that indemnifies the contract’s beneficiaries with a certain amount of money in case the insured dies or becomes disabled due to an accident or serious illness. Some insurance policies even cover the insured’s survival in the event of an event that could have caused death. This insurance serves as a form of economic protection for the family if an unfortunate event happens to the insured, especially if this person is the family’s main provider.

Now, depending on the term for which the contract is in force, there are two types of life insurance:

Permanent life insurance:

This insurance functions as savings the insured can draw on within the contract terms. He can withdraw part of his insured capital, invest it or use it as a guarantee in bank loans. These premiums are usually higher, given the level of flexibility offered to the insured. In this type of insurance, the policyholder decides when to terminate the policy, except in the circumstances delimited by the contract in which the company is given the power to terminate it.

Term life insurance:

As its name indicates, this type of insurance is not indefinite but has an expiration date. During this term, the policy premium does not vary until it is renewed. When the policy is renewable, the insured does not need to repeat the medical exams to qualify, even if he/she is already at an advanced age. On the other hand, when the policy is non-renewable, the insured must pass the medical exams again when the contract expires. In terms of cost, term insurance is more affordable.

With this in mind, let’s look at how Walnut Term Life Insurance works and its features and costs.

How does Term Life Insurance work?

Walnut Term Life Insurance is a product the company offers in association with SBLI, an insurance company with a financial strength rating (FSR) from AM Best. It is a 10- or 20-year term insurance product, which can insure between US$ 50,000 and US$ 1,000,000.

In addition, it allows the contracting of additional benefits for members, which include:

- Headspace mental health and wellness guides.

- Premium protection from Dashlane.

- On-demand video fitness classes with Classpass.

One of the advantages of this life insurance is that, unlike other traditional insurance, Walnut does not request medical exams from the applicant to complete the contracting process. The company is in charge of doing the necessary research for each applicant, so it does not ask for medical tests.

Below, we will look at some of the points you should keep in mind to understand how Walnut term life insurance works:

What happens if the insured does not require coverage during the insurance term?

Because this insurance has a set term, it is important to remember that if the policyholder outlives this time or nothing happens to him/her, that would trigger the insurance coverage. He/she would not receive a premium return, nor would his/her beneficiaries. However, the policyholder can renew the insurance to remain protected by paying a new premium.

Is anyone approved for term life insurance?

Remember that, as with any insurer, the company reserves the right of eligibility when approving applicants’ policies. The fact that Walnut does not require medical examinations does not mean that any applicant, regardless of his or her circumstances, should or can be approved.

You may contact the company’s customer service if your application is denied by emailing support@gowalnut.com.

Why do you require my SSN and personal information?

Walnut works online, so the applicant must provide the necessary information for identification and verification. Both the SSN and the questions asked in the application process are necessary for the company to determine if you are eligible or not. This information is protected as the company complies with Canadian and U.S. data protection and privacy laws.

How much does Term Life Insurance cost?

Taking out life insurance can be expensive, depending on the type of insurance and the company you choose. However, Term Life Insurance is characterized by its affordability, which seeks to be an inclusive and valuable product.

The cost of your insurance premium will depend on multiple factors, such as age, height, and weight, amount insured, term of insurance, even the area of residence.

For 10-year policies, a middle-aged person (between 30 and 35 years old) can have a premium of less than US$ 10/month for a capital sum insured of US$ 50,000 and up to US$ 35/month for the maximum coverage of US$ 1 million.

On the other hand, this same person can choose the 20-year term policy, in this case, the monthly premium for an insured capital of $50K would also be close to US$ 10/month. Still, the premium will be approximately US$ 48 for a capital of one million dollars.

Now, if you want to obtain additional benefits for members, keep in mind that this will increase the value of your monthly premium. To quote your premium, you must go to Walnut’s official website and request your quote in a few minutes.

Means of payment

Being a relatively new company, Walnut is in the development process, so its product offerings and payment methods are limited. Life insurance can only be paid by wire transfer (ACH).

How much coverage do I need on my life insurance?

Walnut offers maximum coverage of $1,000,000 per policy on its life insurance. One way to estimate how much capital you need to insure in your case is to multiply your annual income by 10. This amount should be enough for your beneficiaries to cover their financial needs. However, each case is different; while one policyholder may need less than this amount, another may need more depending on his or her specific family burdens and financial needs.

Is it safe to use Term Life Insurance?

Walnut Insurance Inc. is a Canadian registered company with its head office in Toronto. It is also registered in most U.S. states, with open registration processes in the remaining states. In these cases, Walnut relies on one of its partners in issuing insurance, Nimbus 7 Inc.

Is Walnut Insurance legal?

Below is the list of provinces and states in which Walnut is licensed.

Walnut Insurance Inc. licenses (Canada)

- Alberta – Accident and Sickness: S-3294786-11208101-2021

- Alberta – Life: P-3294786-11208101-2021

- British Columbia: LIC-2022-0035351-R01

- Manitoba – Accident and Sickness: AIA-48218-2952-2021

- Manitoba – Life: LIA-48218-2952-2021

- Northwest Territories: NT-A4-9361-2022

- Nova Scotia: 21 3847113 00F2

- Nunavut: 20219819

- Ontario: 37990M

- Prince Edward Island: 48248

- Saskatchewan: 085760

- Yukon: 2124-17-9900

Walnut Insurance Services LLC Licenses (United States)

- Alaska: 3001246354

- Arizona: 3001278744

- Arkansas: 3001246166

- Colorado: 685626

- Connecticut: 2715304

- Delaware: 3001214667

- District of Columbia: 3001224533

- Georgia: 217886

- Hawaii: 530686

- Idaho: 840033

- Illinois: 3001246191

- Indiana: 3647445

- Iowa: 3001267359

- Kansas: 861926228

- Kentucky: 1125064

- Louisiana: 920054

- Maine: AGN378024

- Maryland: 3001267273

- Minnesota: 40731559

- Mississippi: 1504055

- Missouri: 3001269780

- Nebraska: 3001224668

- New Hampshire: 3001246293

- New Jersey: 3001224710

- New Mexico: 3001263495

- North Carolina: 3001224557

- North Dakota: 3001224633

- Oklahoma: 3001224640

- Oregon: 3001237497

- Rhode Island: 3001224644

- South Carolina: 3001224703

- South Dakota: 10028144

- Tennessee: 3001224555

- Texas: 2645548

- Utah: 839926

- Vermont: 3659516

- Virginia: 151034

- Washington: 1097949

- West Virginia: 3001246661

- Wisconsin: 3001224667

- Wyoming: 459041

Trust

Walnut is a company that enjoys having high-level partners, such as SBLI Insurance, Nimbus 7 Inc, Dashlane, and CyberScout, among others. These agreements give strength to Walnut’s offer, as well as the assurance to customers that their coverage will be executed at the time it is required.

Pros

- No medical exams are required for applicants between the ages of 18 and 60.

- Fast, 100% online, paperless process.

- The premium price is fixed for the term selected for the insurance. It may vary only at the time of renewal.

- 24/7 customer service.

- Discounts on additional coverages.

Cons

- Walnut does not offer permanent life insurance.

- Not available in New York (United States) or the provinces of New Brunswick and Quebec (Canada).

To conclude with Walnut Term Life Insurance

Based on our analysis, we can conclude that Walnut Term Life Insurance is an excellent alternative to guarantee our family’s financial peace of mind during a crisis. Starting with the fact that it is a legal company with the backing of SBLI, an insurer with more than 100 years of presence in the market.

Another point that makes this insurance a recommendable option is that it has a competitive cost and is easy to contract. You don’t even need prior medical exams to attend face-to-face appointments at an insurer’s office or talk to an agent (although you will be able to do so if you need help). The whole process is completely online, fast, and paperless. Simply set the conditions you want for your insurance, quote, pay, and you’re done.

Remember that during the selected period, the premium will remain the same but may change at the time of renewal. However, the advantage of this type of insurance is that it is more affordable than permanent life insurance. So, it is ideal for people with a limited budget who want to provide their families with financial security.

The main disadvantage of Walnut’s Term Life Insurance is its lack of term flexibility, as only 10 and 20-year terms are available. Considering that other insurers offer a wider range of options, it is important to consider whether these terms are what you are looking for in your insurance.

Other than this, the fact that it only offers term but not permanent life insurance makes this policy an option worth evaluating when looking for coverage to protect the people we love.

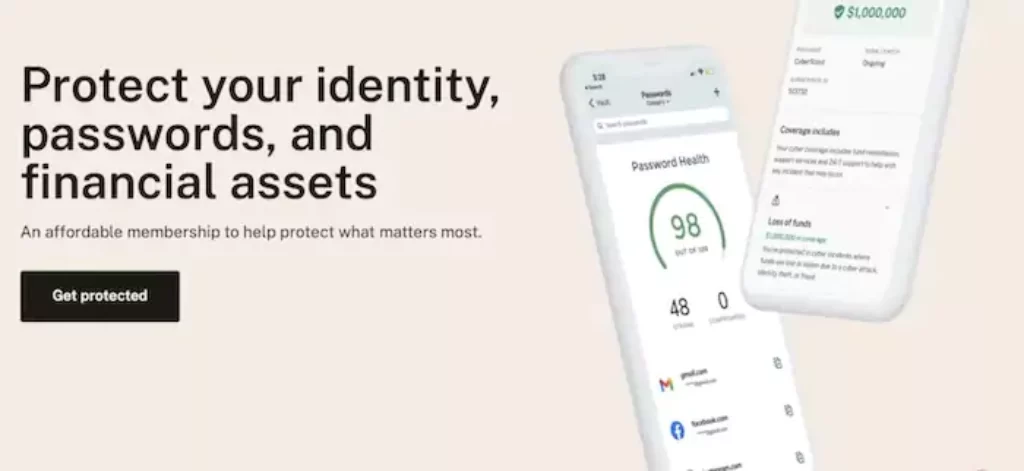

Walnut Digital Protection

The protection of our information has become an issue of vital importance due to the ease with which it can be leaked from our mobile devices and computers. That is why digital protection insurance is increasingly used as a measure of protection and peace of mind. And this is where Walnut Digital Protection comes in, the insurance company that protects your passwords and financial assets against fraudsters and cybercriminals.

Although platforms that involve the traffic of money and financial assets have fairly strong security systems, many users still feel vulnerable to attacks by hackers and hackers. And with good reason, these people break through password and encryption systems with advanced infiltration tools and software. Every day, thousands of Americans report cyber fraud and information theft. That is why, for your peace of mind, Walnut offers Digital Protection coverage, a policy that safeguards your sensitive information and covers you at all times.

In the following Review, we will analyze what Walnut Digital Protection is, how it works, the associated costs, and the pros and cons of this product. Our goal is to clarify any doubts you may have about this insurance to help you determine if it is what you need in your particular case.

What is Walnut Digital Protection?

Walnut is an insurance company based in Canada but registered in most United States states. This insurer’s main mission is to create affordable policies to protect more customers and apply digital transformation to insurance to reach the young population in North America.

Its flagship product is Walnut Term Life Insurance, a 100% digital policy with a 10- or 20-year term covering people up to the age of 70, in many cases without requiring prior medical exams.

However, this post will focus on an equally important coverage since it is intended to protect the wealth that belongs to us. We are talking about Walnut Digital Protection insurance, a policy created to protect our sensitive information from cyber-attacks and hackers and to cover identity theft and fraud, of which the client may be a victim.

For this insurance, Walnut has created agreements with important companies dedicated to protecting the identities of more than 19 million customers worldwide. One of them is CyberScout, a company that, since 2003, has created a portfolio of more than 4 million customers in more than 45 countries.

The membership includes premium protection from Dashlane, a company dedicated to protecting passwords and personal information. Since 2012, this company has built a portfolio of more than 15 million customers, including more than 20,000 enterprise customers. This, undoubtedly, is a seal of quality for Walnut Digital Protection Insurance.

How does Walnut Digital Protection work?

Walnut’s Digital Protection Membership plan is a separate coverage from term life insurance, so you are not required to have both products. With this membership, you enjoy protection for your identity, personal information, passwords, and financial assets from the following partners:

CyberScout

Identity reimbursement coverage of US$ 1,000,000 if the customer becomes a victim of identity theft or fraud.

- Ransomware coverage of US$ 25,000.

- Social engineering coverage of US$ 25,000.

- 24/7 cyber support line, which you can call to answer any questions, request reports, and even resolve incidents.

- Credit monitoring services.

Dashlane Premium

- Unlimited password storage.

- Encrypted file storage (1 GB).

- Dark web monitoring.

- Customizable security alerts.

- Secure notes.

- Password checker.

- Random password generator.

- Automatic password changer.

- Auto-complete forms and payments.

- Unlimited device access.

- Secure password sharing.

By bundling these two products into a single membership, Walnut offers its customers complete protection to their personal and financial information and passwords on any website or transactional platform.

Digital Protection Membership can be ordered 100% online, which makes this insurance very convenient to sign up for. Simply create an account on Walnut, choose the billing plan that suits you best, enter your details and complete the payment process. Your CyberScout policy will be active in a few minutes, plus Dashlane Premium.

How much does Walnut Digital Protection cost?

One of the advantages of Walnut is that it is a fairly straightforward platform, and the information about your rates is concise and without small print.

Walnut Digital Protection Membership can be paid for in two ways:

- Monthly: You enjoy the CyberScout coverages and password protection of Dashlane’s Premium plan for as little as US$10 per month. The quote is very quick, and it only takes a few minutes to get your policy.

- Annual: This plan costs US$ 100 per year, which represents savings of 17% over the monthly plan. If you are one of those who think long term, this plan is the most recommendable, since you will be protected for a year and, in addition, save money during this time.

It’s that simple. When you register on Walnut’s platform, you only need to enter your associated email address, fill out the contact information, and select the payment method. And that’s it. All your information will be secure in just a few minutes and for a very reasonable investment. You will enjoy excellent coverage if your information is stolen or you become a victim of cyber fraud.

Payment methods

Walnut accepts bank account (ACH) payments for term life insurance and digital protection insurance. However, the company is constantly evolving to offer its customers the greatest accessibility, so we do not rule out that more payment methods will be available shortly.

Is it safe to use Walnut Digital Protection?

Yes, Walnut Insurance Inc. is a reliable company with the necessary licenses to operate in the United States and Canada. In addition, it is backed by Nimbus 7 Inc. Another registered insurance company serves as an intermediary in the states where Walnut is not yet licensed.

Legality

These are the license numbers held by Walnut in Canada and the United States:

Canada: Walnut Insurance Inc.

| Alberta – Accident and Sickness: S-3294786-11208101-2021

Alberta – Life: P-3294786-11208101-2021 British Columbia: LIC-2022-0035351-R01 Manitoba – Accident and Sickness: AIA-48218-2952-2021 Manitoba – Life: LIA-48218-2952-2021 Northwest Territories: NT-A4-9361-2022 |

Nova Scotia: 21 3847113 00F2

Nunavut: 20219819 Ontario: 37990M Prince Edward Island: 48248 Saskatchewan: 085760 Yukon: 2124-17-9900 |

United States: Walnut Insurance Services LLC

| Alaska: 3001246354

Arizona: 3001278744 Arkansas: 3001246166 Colorado: 685626 Connecticut: 2715304 Delaware: 3001214667 District of Columbia: 3001224533 Georgia: 217886 Hawaii: 530686 Idaho: 840033 Illinois: 3001246191 Indiana: 3647445 Iowa: 3001267359 Kansas: 861926228 Kentucky: 1125064 Louisiana: 920054 Maine: AGN378024 Maryland: 3001267273 Minnesota: 40731559 Mississippi: 15040550 Missouri: 3001269780 |

Montana: 3001246175

Nebraska: 3001224668 New Hampshire: 3001246293 New Jersey: 3001224710 New Mexico: 3001263495 North Carolina: 3001224557 North Dakota: 3001224633 Oklahoma: 3001224640 Oregon: 3001237497 Rhode Island: 3001224644 South Carolina: 3001224703 South Dakota: 10028144 Tennessee: 3001224555 Texas: 2645548 Utah: 839926 Vermont: 3659516 Virginia: 151034 Washington: 1097949 West Virginia: 3001246661 Wisconsin: 3001224667 Wyoming: 459041 |

Walnut Insurance Services LLC is in the process of licensing the remaining states. However, it is possible to request your quotes through Nimbus 7 Inc. a licensed company in the States:

- Alabama: 3000479673

- California: 0M90634

- California: 0M90634

- Massachusetts: 2083017

- Michigan: 118524

- Nevada: 3414602

- Ohio: 1229537

- Pennsylvania: 887245

Trust

Walnut has a fairly explicit privacy policy in which the user can verify what kind of information the company collects from the customer and how it does so. It also specifies the information it collects through cookies, automatic data collection technologies, and third-party tracking technologies.

Walnut also establishes criteria for the use of such information and the transfer of customers’ personal information. These policies are required for registered companies, which gives confidence to the user.

What do other users think?

While you will find few users review overall regarding the Walnut Life insurance and Digital protection assets, the company is overall well taken by their clients. It has a solid 3.7/5.0 rate on review sites.

User support

If you have any questions regarding the products and services offered by Walnut, you can ask a question on their live chat, contact the company via email at support@gowalnut.com, or call 1-888-966-5308. For questions about the Terms of Use or privacy policies, you can send an email to lega@gowalnut.com.

Pros

- In the Digital insurance platform, all contracting is done 100% online.

- Life insurance without previous exams and at competitive prices.

- Fast quotes.

- Discounts on additional coverage.

- Simple and easy-to-use interface.

- Transparent pricing and rates, with no hidden charges.

- Fast processing of applications.

- Excellent customer support.

- Digital protection coverage of US$ 1 million for only US$ 10 per month.

- Walnut has an affiliate program that pays each user who takes out term life insurance or digital protection insurance.

Cons

- Not available in New York (United States) or the provinces of Quebec and New Brunswick (Canada).

- Does not offer permanent life insurance.

At the end

In summary, the Walnut Digital Protection membership is a highly recommended product, given the steady increase in fraud and identity theft cases suffered by hundreds of thousands of Americans. It is best to pay for the one-year plan, which costs US$ 100. But if you do not have this amount, you can make monthly payments of US$ 10, accessing the same benefits and coverage.

One of Walnut’s advantages is that, despite being a relatively young company, it has managed to capture the attention of millions of customers, both for its term life insurance and digital protection coverage. One of the drivers behind this growth has been the accessibility provided by the company, as it is a digital platform that offers excellent coverage in a simple and accessible way.

In the case of the Digital Protection membership, the coverage of fraud or identity theft is not bad at all. It is backed by a company trusted by nearly 20 million customers worldwide. It also offers the services of Dashlane, a password manager designed as a simple and practical solution to protect not only passwords but all sensitive customer information.

Visit Walnut Term Life Insurance