Sites Like Western Union to Send and Receive Money

Sending and Receiving Money

Sending money and remittances internationally sometimes seems like very complicated management. As a result, many companies, among wallets, banks, and shipping companies that offer this service, choose to work with becomes a difficult task.

Western Union stands out as one of the oldest remittance companies with the most connections worldwide, reaching more than 200 countries and having a network of more than 500,000 nodes – in the form of specialized agents – that allow you to connect with almost any city in the world.

The premise is simple. Western Union allows you to make money transfers through your agents from one place to another in exchange for a deduction based on a fee, which varies depending on how the recipient gets the money you sent. Western Union has been active since 1851, when it was founded as the New York and Mississippi Valley Printing Telegraph Company.

International Money Transfer

This company offers its clients money transfer services, bill payment services, and prepaid cards allowing the transfer of money or schedule payments of bills online, through your mobile phone, from more than 100,000 ATMs, by phone, or by going to one or more than 500,000 agencies located throughout the world.

Western Union is a legitimate entity regulated by the Austrian Financial Markets Authority and local regulators in each country. This includes the FCA in the UK and FinCEN in the US-.

This service is one of the main services to carry out international money transfers since they keep money in stock in dollars and currencies according to each office country, which allows the withdrawal to be faster once the deposit of the sender is confirmed.

Sites Like Western Union

We recommend that you sign up before sending any payment through Western Union. There’s no reason not to start earning points for this membership. If you like how Western Union works and everything is effortless, you’ll love this list of sites like Western Union for sending and receiving money online. Enjoy.

Visit Western UnionMoneyGram

Sending money online is super easy and ultra-fast with this alternative to Western Union called MoneyGram. MoneyGram is the cheapest way to send money online to anyone worldwide. On this site, you will find a mobile wallet. Cash picks up possibilities, bank-to-bank transfers, and more.

MoneyGram has over 350,000 physical locations worldwide, making it one of our list’s largest money transfer sites. Create your free account to send cash online and track all your transactions.

Travelex

Travelex is another cheapest way to transfer money online. With Travelex, you can send foreign money, travel money, travelers’ checks, and more any day. Travelex is open to you 24/7, and there’s always someone standing by if you need a little extra help or have a question for this company.

You will also find a foreign currency exchange tool and many possibilities to transfer your cash online and in physical locations worldwide, including airports. Travelex is fast, affordable, and very easy to use. This site must be considered the next time you have to make a money transfer. You won’t regret it, guaranteed.

TransferWise

If you need to send money abroad or to someone who lives just a few blocks from your home, you should consider this alternative to Western Union called TransferWise.

TransferWise removes the extra fees that most banks will charge you for an international transfer, saving you a ton of money you weren’t expecting to spend.

On this site, you can send money easily and without fuss. Everything will be done quickly so that you won’t leave your friend or family member hanging the next time they need to borrow money.

HIFX

Another great online money transfer site like Western Union, HIFX, is much cheaper than normal banks. To get started, you can quickly sign up for a free account on this site. You can use HIFX to transfer money to an individual or set up recurring payments for your business account.

HIFX is hassle-free, and its rates are very affordable. This online money transfer service works with over 120 countries and currencies worldwide.

If you want to see the exchange rate before sending, you can check out the currency exchange rate calculator, and don’t forget to keep track of your cash with the tracking number provided with each transaction.

Just because HIFX is mentioned last on our list doesn’t mean it should be ignored. On the contrary, this place is one of our list’s most trusted and efficient money transfer sites.

OFX

OFX is one of the best international money transfer sites, similar to Western Union on our list. This money service site has it all. On the OFX site, you will find many business transfer options. To estimate the currency exchange rate costs, you need to understand how much you’re sending and a currency converter.

The fees are affordable, the transfers are done fast, and you will track each transaction you make on this site. Enjoy.

WorldRemit

WorldRemit works with three easy steps. First, choose the country you want to send your money to, choose a service like cash pickup or online money transfer, and hit the send button.

You will be shown all the fees and exchange rates before completing your transaction, and you will be given a tracking number to see where your money is until it reaches its destination. This money service site works internationally, and the fees are very affordable.

PayPal

The cheapest way to send money online to someone else is called PayPal. PayPal doesn’t charge you anything to make a transfer, but the catch is that you must have a balance in your PayPal account.

Transferring money from your bank account to PayPal is also free, but it can take a few weeks. If you want a quicker option, try one of the other sites mentioned on this list. PayPal works internationally, and it’s accepted on most websites worldwide.

Many people use them online, pay their employees, purchase new things, and pay for online services and software. If you don’t have a PayPal account, you should create a free one now. This money website is a must-have and works just about everywhere online. They are 100% free to use and always include buyer’s insurance.

Xoom

Xoom is a part of PayPal that not everyone knows about. Xoom is a great way to instant money transfer online without fuss. On Xoom, you can transfer any amount online safely and quickly.

You will also save on the horrendous fees found with other money transfer sites. This online transfer service is available worldwide. It works with over 1000 locations around the world. Start by picking the to and from location to get started, and don’t forget to add the money transfer app for quick transfers.

Create your free account now because if you need to send money online, you’ll use this one again. We’re sure of it.

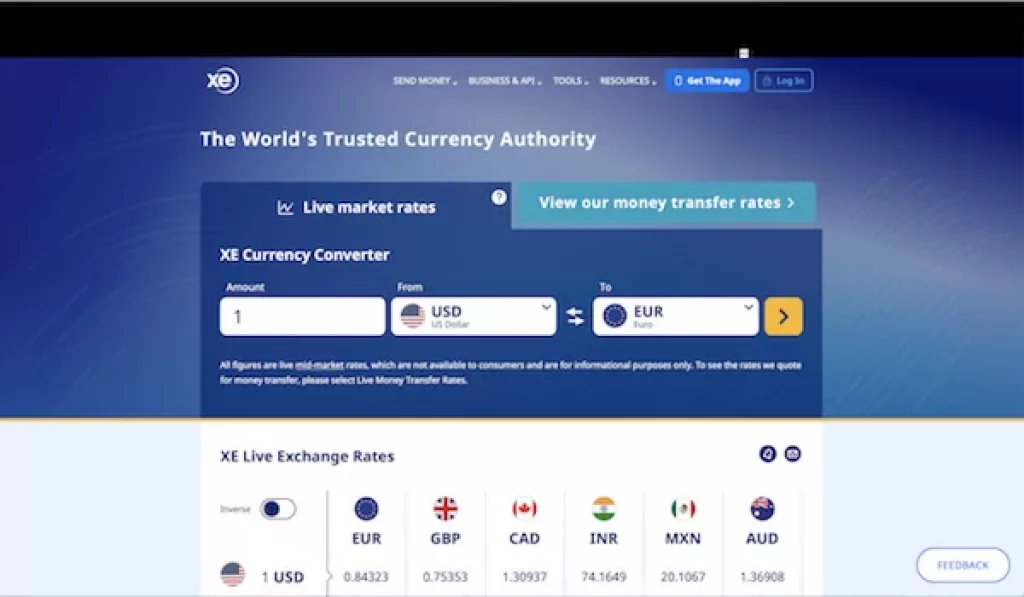

Xe

If you need to do an international money transfer, you’ll love Xe, which used to be called CurrencyOnline. Xe is a 24-hour service that makes international payments and transfers easy and inexpensive.

This online service will give you a tracking number and a detailed list of your fees before each transaction. They have affordable rates, and it’s one of your best options if you have to send money to an obscure place that isn’t always available on other money lending sites.

A friendly team is waiting to help you if you need a helping hand, and you will also find a market insight tool on this site that can tell you the current exchange rate so that you’ll always know exactly how much you’re spending on all currencies.

TorFX

TorFX is an award-winning, five-star rated currency exchange site for everyone worldwide. You will find a quote with each transaction on this site, amazing rates guaranteed to suit your budget, excellent customer service, and never, ever any hidden fees.

TorFX has special savings for those who need to make many transfers and other things like their detailed account manager to keep track of all your transactions in one place. This currency broker and international money transfer site are one of the best on our list, and it should be considered each time you need to send money online.