Best Payday Loan Companies Like MoneyLion

USANewLoan

You can be minutes away from registering for a new loan using an incredibly straightforward application process. This is similar to other sites like MoneyLion, where you are matched with independent, third-party lenders based on what you are looking for.

You can select between a payday loan or an installment loan, each having its own set of conditions ad rates that will be sent for your agreement if the loan is approved. Then, please fill out the application form, and wait for the lenders to reply with their offers.

To know more about USANewLoan: USANewLoan.com Review

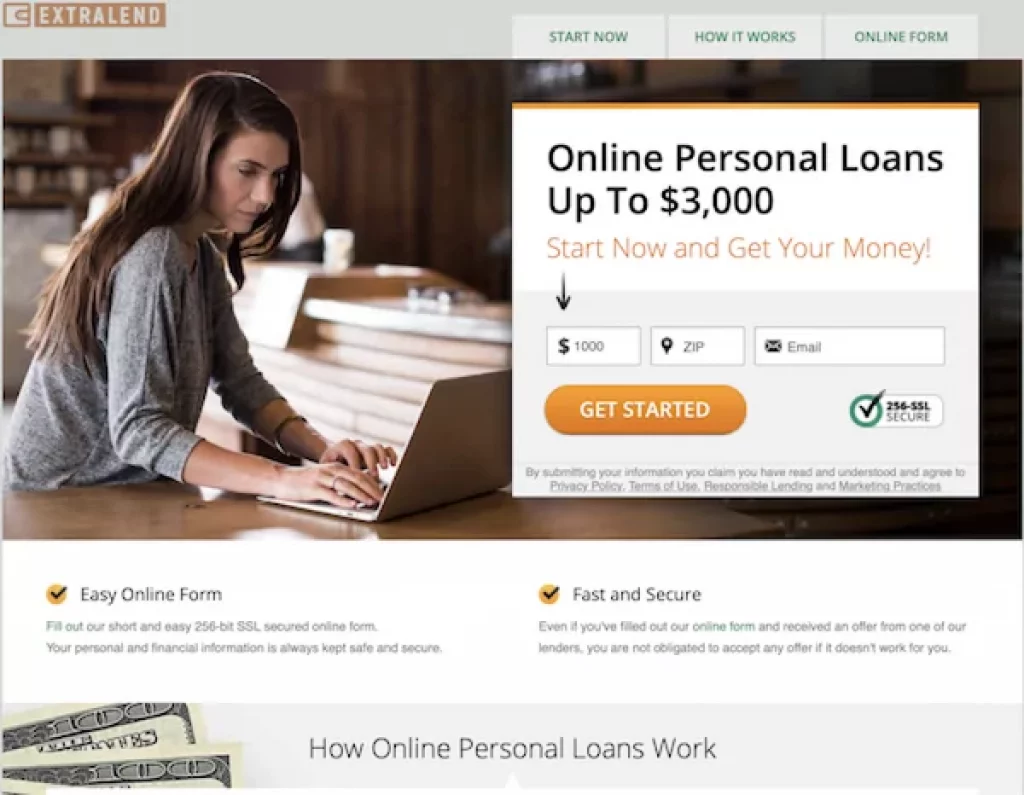

ExtraLend

Another one of the best payday loan companies like MoneyLion for cash loans is ExtraLend, where consumers are matched with lenders across the country. Your basic information and the amount you wish to borrow are forwarded to them so that you can receive a suitable loan offer.

There is no obligation to accept these offers; nothing will happen until you provide your electronic signature on the loan agreement. One advantage is that your credit history is not a critical issue in most cases since companies like DP and TeleTrack perform alternative credit checks.

To know more about ExtraLend: ExtraLend Review

LoanCowGirl

Official Site

Need money fast? Emergencies or the need to take a little vacation trip can happen anytime, and quick access to cash might be necessary. This MoneyLion alternative lets you get a cash loan within one hour. Once you submit your application, it is received by an extensive network of lenders, and some of them reply within minutes.

If the loan is approved, you will be sent to the lender’s website to review all the details, rates, fees, and other relevant information. After you agree with them, the money will be deposited into your bank account.

LendingPoint

Affordable personal cash loans are unlocked here. Compared to other cash loans like MoneyLion, the difference is that they focus more on your financial potential than your past. Several factors are considered with your application; job history, economic history, income, and credit behavior are examples.

To expedite the approval process, it is recommended to have proof of income and employment, your most recent bank statements and a check that has been voided, and a government-issued ID or driver’s license on hand.

Blue Trust Loans

Apply for an installment cash loan for a better alternative to payday loans. If you can provide a verifiable income source, have an open checking account, are a US citizen of at least 18 years old, and are not currently a debtor in a bankruptcy case, you can apply.

Fill out an online form, and you can eSign the loan documents immediately if approved. If you pay on time and are in good standing, you can join Club Blue and gain access to higher loan amounts, longer loan terms, and lower rates.

Cash-advance-loans

Like some websites like MoneyLion, cash-advance-loans is not a lender and doesn’t make loans; instead, it connects you with lenders through a simple process. After you send your application, it is encrypted and forwarded to authorized lenders for approval. So instead of visiting several websites and sending applications to each one, you can use this one and have your request viewed by many lenders at once.

MoneyLion

Personal loans are better than payday loans, but that doesn’t mean every business is trustworthy. Some companies are still out to scam you out of getting the help you need while claiming your hard-earned money for themselves. So how can you avoid getting sucked into their empty promises?

Consider using MoneyLion, a full-service app and personal loan company featured in Forbes magazine and other reputable sources. This review mainly discusses what you receive with a MoneyLion personal loan and looks at what the innovative app can do for your financial wellness.

What Is MoneyLion?

Signing up with MoneyLion gets you much more than access to loans. But instead brings the experience of interactive and progressive banking to you online. It’s a full-featured service that helps clients build financial stability and learn healthy spending and saving habits while monitoring their credit.

While they offer loans, MoneyLion is more than just a place for quick cash. To get the incredible app’s full experience, you should become a Plus member to receive all the incredible benefits that save your credit and help you save up and avoid overdrafts.

Before moving on to the rest of this amazing service, let’s talk about what MoneyLion personal loans are like.

If you are a MoneyLion Plus member, you will have access to better rates, faster cash, and advanced reward systems for a monthly subscription price. We will discuss the MoneyLion Plus app and membership features later.

How Can You Apply For MoneyLion Loans?

If you aren’t a MoneyLion Plus member, getting approved for a personal loan is harder than it would be at smaller businesses. MoneyLion has firmed requirements to ensure they stay a helpful, long-lasting company. Even if you don’t qualify now, you will get better offers as an app member.

To get approved for a MoneyLion personal loan, you’ll need to meet these requirements:

- 18+

- Legal resident in the USA

- 640 or higher credit score

- Minimum income of $36,000

- Valid checking account in your name

- $1,000 – $35,00 range

- APR starts at 5.99% and goes up from there

- Maximum 3-year loan term

- NO, prepay fee for paying off your loan early.

- Origination fee up to 6% taken out immediately

- Stricter approval guidelines

- Live in a state where MoneyLion works out of*

*MoneyLion is available in 45 states, excluding Vermont, Colorado, West Virginia, New York, and Connecticut

Applying can be done easily online, and the customer support staff is readily available to help walk you through the standard application process.

Check Out MoneyLion Plus!

Besides offering financial services and personal loans, MoneyLion Plus is an amazing cash advance app fully equipped to provide endless help on having the best financial circumstances possible. Seriously, this app sets the bar for others of its kind and can be used for so much more than quick, easy money.

MoneyLion Plus has tons of things included in the app, but some of the best features are:

- Cash advances up to $500 with low rates.

- Daily tip cards and features for financial monitoring and assistance

- $1 cash-back every day you log in

- A savings account system used as collateral for loans and advances

- Much looser requirements for cash advances

- Credit building help

For those wanting more than just a loan and are willing to pay a monthly price of $25 for everything MoneyLion Plus has to offer, it’s a steal of a deal and at least worth checking out. The app is available on both Apple and Android devices and is accessible online.

Will MoneyLion Work For You?

MoneyLion is a huge company with many resources and ways to access them, from personal loans to customized financial assistance and easy cash advances. They aren’t the cheapest and have additional fees that make the low APR less tempting, but they’re trustworthy and have built an amazing client base of over 2,000,000 people.

Visit MoneyLion